CABINET DECISION - IMPLEMENTATION OF 7TH CPC TO DEF PERS

The Cabinet in its meeting on 03 May 2017 approved the implementation of 7th CPC for def pers. The Press Release from PIB is placed in the succeeding paragraphs for your information. Links to other posts on 7 CPC are also placed at the end of this post. Consequently the Ministry of Defence too has issued Gazette notifications as Pay rules for Army Navy and Air Force as implementation instructions. These are placed below and can be accessed or downloaded by clicking on them:-

* 7th CPC Army Pay Rules Offrs

* 7th CPC Pay Rules JCOs OR

* 7th CPC Navy Pay Rules Offrs

* 7th CPC Air Force Pay Rules

* 7th CPC DEF PAY MATRIX (OFFRS)

* DOPPW LETTER (Pay Fixation) 12-MAY-2017(IMPORTANT)

* CIVIL CG EMPLOYEES 7 CPC PAY MATRIX

* DEFENCE CIVILIAN PENSIONERS - CIR C-164 DT 30 MAY 2017

CABINET DECISON TAKEN ON 03 MAY 2017 ON THE IMPLEMENTAITON OF 7 CPC FOR SERVING DEFENCE PERSONNEL

PAY FIXATION OF SERVING CENTRAL GOVT EMPLOYEES AS ALSO PENSION FIXATION OF CG PENSIONERS ( DETAILED ORDERS FOR DEFENCE AWAITED BUT METHOD WILL BE SIMILAR)

The Cabinet in its meeting on 03 May 2017 approved the implementation of 7th CPC for def pers. The Press Release from PIB is placed in the succeeding paragraphs for your information. Links to other posts on 7 CPC are also placed at the end of this post. Consequently the Ministry of Defence too has issued Gazette notifications as Pay rules for Army Navy and Air Force as implementation instructions. These are placed below and can be accessed or downloaded by clicking on them:-

* 7th CPC Army Pay Rules Offrs

* 7th CPC Pay Rules JCOs OR

* 7th CPC Navy Pay Rules Offrs

* 7th CPC Air Force Pay Rules

* 7th CPC DEF PAY MATRIX (OFFRS)

* DOPPW LETTER (Pay Fixation) 12-MAY-2017(IMPORTANT)

* CIVIL CG EMPLOYEES 7 CPC PAY MATRIX

* DEFENCE CIVILIAN PENSIONERS - CIR C-164 DT 30 MAY 2017

CABINET DECISON TAKEN ON 03 MAY 2017 ON THE IMPLEMENTAITON OF 7 CPC FOR SERVING DEFENCE PERSONNEL

PAY FIXATION OF SERVING CENTRAL GOVT EMPLOYEES AS ALSO PENSION FIXATION OF CG PENSIONERS ( DETAILED ORDERS FOR DEFENCE AWAITED BUT METHOD WILL BE SIMILAR)

PAY FIXATION UNDER RULE 7 (ARMY OFFRS)

Step - 1 Note existing Basic Pay plus Grade Pay (6th CPC).

Step - 2 Multiply by 2.57 and Round off to nearest rupee.

Step - 3 Look up above in Pay matrix under appropriate level the Cells in between this may fall unless cell with similar value exists.

Step - 4 Take higher on as the new revised basic pay.

For Medicos add DA on NPA (which is 25% of Basic+GP+MSP)as on 01 Jan 2016 (@125%) to the result Fig of Step - 2 before going to Step - 3.

After Step 4 add existing NPA till further orders on the subject.

PAY FIXATION (CIV) - The pay fixation methodology is given in DPPW letter of 12 May 2017 which can be downloaded from above link, which is common to both Civil as well as Def CG Employees. However for Defence separate orders are awaited from Ministry of Defence on revision of pensions. The method is based on fixation of notional pay in the following CPCs based on the Last Pay Drawn as given in the Original PPO of the pensioner. The detailed method given by Bhaat Pensioner's Samaj is as under which may be downloaded by clicking on it, We have also placed the Fixation / Fitment tables for 5th as well as 6th CPCs so that Notional Pays in respect of Pre-Jan 86 pensioners can be calculated for 7th CPC:-

7th CPC HOW TO CALCULATE NOTIONAL PAY & PREPARE PERFORMA.

5th CPC PAY FIXATION TABLES

6th CPC PAY FIXATION TABLES

PRESS RELEASE ----03 MAY 2017

Modifications in the 7th CPC recommendations on pay and pensionary benefits approved by the Cabinet on 3rd May, 2017

The Union Cabinet chaired by the Prime Minister Shri Narendra Modi approved important proposals relating to modifications in the 7th CPC (Central Pay Commission) recommendations on pay and pensionary benefits in the course of their implementation. Earlier, on 29th June, 2016, the Cabinet had approved implementation of the recommendations with an additional financial outgo of ₹84,933 crore for 2016-17 (including arrears for 2 months of 2015-16).

The benefit of the proposed modifications will be available with effect from 1st January, 2016, i.e., the date of implementation of 7th CPC recommendations. With the increase approved by the Cabinet, the annual pension bill alone of the Central Government is likely to be ₹1,76,071 crore. Some of the important decisions of the Cabinet are mentioned below:

1. Revision of pension of pre – 2016 pensioners and family pensioners.

The Cabinet approved modifications in the recommendations of the 7th CPC relating to the method of revision of pension of pre-2016 pensioners and family pensioners based on suggestions made by the Committee chaired by Secretary (Pensions) constituted with the approval of the Cabinet. The modified formulation of pension revision approved by the Cabinet will entail an additional benefit to the pensioners and an additional expenditure of approximately ₹5031 crore for 2016-17 over and above the expenditure already incurred in revision of pension as per the second formulation based on fitment factor. It will benefit over 55 lakh pre-2016 civil and defence pensioners and family pensioners.

While approving the implementation of the 7th CPC recommendations on 29th June, 2016, the Cabinet had approved the changed method of pension revision recommended by the 7th CPC for pre-2016 pensioners, comprising of two alternative formulations, subject to the feasibility of the first formulation which was to be examined by the Committee.

In terms of the Cabinet decision, pensions of pre-2016 pensioners were revised as per the second formulation multiplying existing pension by a fitment factor of 2.57, though the pensioners were to be given the option of choosing the more beneficial of the two formulations as per the 7th CPC recommendations.

In order to provide the more beneficial option to the pensioners, Cabinet has accepted the recommendations of the Committee, which has suggested revision of pension based on information contained in the Pension Payment Order (PPO) issued to every pensioner. The revised procedure of fixation of notional pay is more scientific, rational and implementable in all the cases. The Committee reached its findings based on an analysis of hundreds of live pension cases. The modified formulation will be beneficial to more pensioners than the first formulation recommended by the 7th CPC, which was not found to be feasible to implement on account of non-availability of records in a large number of cases and was also found to be prone to several anomalies.

2. Disability Pension for Defence Pensioners

The Cabinet also approved the retention of percentage-based regime of disability pension implemented post 6th CPC, which the 7th CPC had recommended to be replaced by a slab-based system.

The issue of disability pension was referred to the National Anomaly Committee by the Ministry of Defence on account of the representation received from the Defence Forces to retain the slab-based system, as it would have resulted in reduction in the amount of disability pension for existing pensioners and a reduction in the amount of disability pension for future retirees when compared to percentage- based disability pension.

The decision which will benefit existing and future Defence pensioners would entail an additional expenditure of approximately ₹130 crore per annum.

3. Changes in Pay Structure and Revision of the three Pay Matrices:

The Cabinet, while approving the 7th CPC recommendations for their implementation on 29th June, had made two modifications in the Defence Pay Matrix as under:

(i) Index of Rationalisation (IOR) of Level 13A (Brigadier) may be increased from 2.57 to 2.67.

(ii) Additional 3 stages in Levels 12A (Lt. Col.), 3 stages in Level 13 (Colonel) and 2 stages in Level 13A (Brigadier) may be added.

The Cabinet has now approved further modifications in the pay structure and the three Pay Matrices, i.e. Civil, Defence and Military Nursing Service (MNS). The modifications are listed below:

(i) Defence Pay Matrix has been extended to 40 stages similar to the Civil Pay Matrix: The 7th CPC had recommended a compact Pay Matrix for Defence Forces personnel keeping in view the number of levels, age and retirement profiles of the service personnel. Ministry of Defence raised the issue that the compact nature of the Defence Pay Matrix may lead to stagnation for JCOs in Defence Forces and proposed that the Defence Pay Matrix be extended to 40 stages. The Cabinet

decision to extend the Defence Pay Matrix will benefit the JCOs who can continue in service without facing any stagnation till their retirement age of 57 years.

(ii) IOR for Levels 12 A (Lt. Col. and equivalent) and 13 (Colonel and equivalent) in the Defence Pay Matrix and Level 13 (Director and equivalent) in the Civil Pay Matrix has been increased from 2.57 to 2.67: Variable IOR ranging from 2.57 to 2.81 has been applied by the 7th CPC to arrive at Minimum Pay in each Level on the premise that with enhancement of Levels from Pay Band 1 to 2, 2 to 3 and onwards, the role, responsibility and accountability increases at each step in the hierarchy. This principle has not been applied in respect of Levels 12A (Lt. Col. and

equivalent), 13 (Colonel and equivalent) and 13A (Brigadier and equivalent) of Defence Pay Matrix and Level 13 (Director and equivalent) of the Civil Pay Matrix on the ground that there was a disproportionate increase in entry pay at the level pertaining to GP 8700 in the 6th CPC regime. The IOR for Level 13A (Brigadier and equivalent) in the Defence Pay Matrix has already been revised upwards with the approval of the Cabinet earlier. In view of the request from Ministry of Defence for raising the IOR for Levels 12 A and 13 of the Defence Pay Matrix and requests from others, the IOR for these levels has been revised upwards to ensure uniformity of approach in determining the IOR.

(iii) To give effect to the decisions to extend the Defence Pay Matrix and to enhance the IORs, the three Pay Matrices – Civil, Defence and MNS – have also been revised. While doing so, two calculation errors noticed in the MNS Pay Matrix have also been rectified.

(iv) To ensure against reduction in pay, benefit of pay protection in the form of Personal Pay was earlier extended to officers when posted on deputation under Central Staffing Scheme (CSS) with the approval of Cabinet. The benefit will also be available to officers coming on Central Deputation on posts not covered under the CSS.

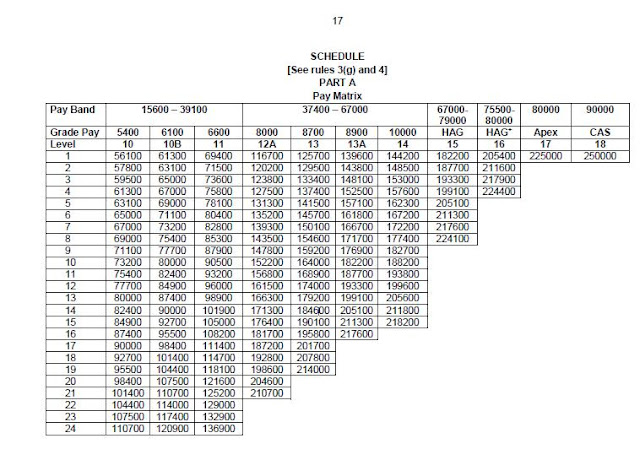

PAY MATRIX CIVIL EMPLOYEES

************GO HOME PAGE *****

Clarifications and update on the Cabinet decisions on pay and pensionary issues emanating out of the 7th Central Pay Commission: By Maj Navdeep Singh (Reproduced from his blog site)

There is a press note floating around on social media regarding certain decisions taken by the Cabinet related to pay and pensionary modalities related to the 7th Central Pay Commission (CPC). Though many have questioned its veracity, this is to confirm that it is absolutely a valid document and has been officially issued by the Ministry of Finance.

That said, let me run through some of the important decisions taken by the Cabinet, clarifications thereon and their impact. Please note that the new Pay Rules issued by the Ministry of Defence do not take into account the changes in the pay structure or removal of anomalies and these shall be incorporated through separate amendments in the rules issued on 03 May 2017.

Restoration of Percentage based Disability Pension Rates

The 7th CPC had recommended ‘flat/slab’ rates of disability pension for the defence services rather than the ones based upon ‘percentage of pay’. Civil disabled personnel were however retained on the percentage system as before. As stated earlier, frankly, I never expected this regressive 7th CPC recommendation to be accepted by the Government, but unfortunately it was. While recommending this aspect, the 7th CPC had also made unfounded and uncharitable remarks against disabled soldiers by casting aspersions on those who have incurred disabilities while in service which was discussed in detail by me earlier in my opeds, here and here. This resulted in a massive decrease after the 7th CPC resulting in a payout even lower than 6th CPC rates for almost all post-2016 retirees of all ranks and also for pre-2016 retirees of certain ranks. The arbitrariness of this decision becomes evident from the following chart at the apex levels:

Thankfully, the then Defence Minister, Mr Manohar Parrikar, fully understood the issue and took personal interest in getting the issue referred to an Anomaly Committee. The Defence Services HQ as well as the Ministry, and even civilian employee organisations, supported the resolution of this anomaly which now stands addressed and the Cabinet has decided to retain the old system of calculation on percentage basis, that is, 30% of pay shall remain the disability element for 100% disability. I however do hope that a protection clause is introduced for pre-2016 retirees of lower ranks who stood to gain from the slab rates.

Improvement in Pension calculation system for pre-2016 civil and defence retirees

The Cabinet has also accepted an improvement over and above the system of pension calculation which was finally effectuated after the 7th CPC. Rather than basing the pensionary calculations on the “Old Pension X 2.57” formula, an option would be provided to calculate the pension based upon the notional pay stage from which the employee had retired as opposed to the minimum of pay as was the system followed till the 6th CPC. Calculation of pension in this manner would definitely enhance the pension of civil pensioners and perhaps a small number of defence pensioners, who, in all probability would be provided the opportunity of choosing the most beneficial option, that is, the new formula, 2.57 multiplication formula or OROP rates. Contrary to popular perception, this does not exactly result in OROP for pre-2016 civil employees as is being projected, since while this is based on notional data, the military OROP is operated on live date of fresh retirees, moreover while this system is expected to be revised only after ten years, the military OROP as per the current scheme is meant to be revised after every five years.

Issuance of Pay Rules rather than Instructions on Pay

There were messages that the Chiefs of the Defence Services have been sidelined and downgraded since the earlier system of issuance of Special Army Instructions, Special Navy Instructions and Special Air Force Instructions (SAI/SNI/SAFI) has been discontinued and a new dispensation of ‘Pay Rules’ has been initiated. This seems to be the negative imagination of fertile minds. SAI/SNI/SAFI were never issued under the authority of the Chiefs of the Defence Services HQ but were always issued by the Ministry of Defence, that is, the Government of India. ‘Orders’ such as Army Orders (AO) etc were (and are) issued by the Defence Services HQ under the power of the Chiefs. The new Pay Rules have been promulgated under the authority of Article 309 of the Constitution of India and are statutory in character rather than being mere executive instructions like was the case till now. With this, the pay rules of the Defence Services are at par with the statutory pay rules of the civil services which are also issued under the authority of Article 309 of the Constitution of India.

Defence Pay Matrix to have 40 stages

The 7th CPC had recommended only 24 stages in the defence matrix while 40 stages were provided to civilians. This anomaly has been rectified and now the defence pay matrix shall also have 40 stages. This will particularly be helpful for JCOs towards the retiring years and will also beneficially affect their pension and other retiral benefits.

Multiplication factor of 2.67

This anomaly had been rectified earlier for Brigadiers and a multiplication factor of 2.67 had been applied for the said rank. Now the same benefit has also been extended to Lieutenant Colonels, Directors to Government of India and Colonels, that is, Levels 12A and 13 of the Pay Matrix.

Other Anomalies

There shall be pay protection for the amount of Military Service Pay (MSP) on promotion from the rank of Brigadier to Major General. It may be recalled that MSP is not entitled to ranks above the rank of Brigadier. No decision has been taken by the Government on the aspect of Non Functional Upgradation till now since the matter is being considered sub judice. On directions of the Supreme Court, the Government is re-considering the issue of NFU for Central Armed Police Forces for which a meeting was recently held. The issue is to be considered by the Government and the fresh decision is to be placed before the Supreme Court in August 2017. The most pertinent anomaly of enhancement of Military Service Pay, especially for JCOs, also remains pending along with other matters and probably these issues would be clearer after various anomaly committees submit their reports and a decision is taken thereafter by the Cabinet. The committee on allowances has already submitted its report which will now be examined by the Government. Unlike pay and pension which are admissible retrospectively from 01 January 2016, most freshly rationalized allowances shall only be admissible prospectively.

This is all I have to say at present, please DO NOT mail me individual queries on email or social media. You are free to discuss the above @ the comments section of this post.

Maj Navdeep Singh

*********************GO HOME PAGE *****

We have placed all other details on 7th CPC incl the implementation Instructions in this blog site covering all aspects for all Civil and Def CG Employees and Pensioners under following posts (CLICK ON TITLES) :-

a) 7th CPC IMPLEMENTATION 2016 - ALL IN ONE DETAILS

b) 7th CPC DEFENCE PENSIONS - GAIN OR NO-GAIN

c) EXERCISING OPTIONS FOR FIXATION IN JAN OR JUL 2016 (SERVING)

OLD POSTS

Step - 1 Note existing Basic Pay plus Grade Pay (6th CPC).

Step - 2 Multiply by 2.57 and Round off to nearest rupee.

Step - 3 Look up above in Pay matrix under appropriate level the Cells in between this may fall unless cell with similar value exists.

Step - 4 Take higher on as the new revised basic pay.

For Medicos add DA on NPA (which is 25% of Basic+GP+MSP)as on 01 Jan 2016 (@125%) to the result Fig of Step - 2 before going to Step - 3.

After Step 4 add existing NPA till further orders on the subject.

PAY FIXATION (CIV) - The pay fixation methodology is given in DPPW letter of 12 May 2017 which can be downloaded from above link, which is common to both Civil as well as Def CG Employees. However for Defence separate orders are awaited from Ministry of Defence on revision of pensions. The method is based on fixation of notional pay in the following CPCs based on the Last Pay Drawn as given in the Original PPO of the pensioner. The detailed method given by Bhaat Pensioner's Samaj is as under which may be downloaded by clicking on it, We have also placed the Fixation / Fitment tables for 5th as well as 6th CPCs so that Notional Pays in respect of Pre-Jan 86 pensioners can be calculated for 7th CPC:-

7th CPC HOW TO CALCULATE NOTIONAL PAY & PREPARE PERFORMA.

5th CPC PAY FIXATION TABLES

6th CPC PAY FIXATION TABLES

PRESS RELEASE ----03 MAY 2017

Modifications in the 7th CPC recommendations on pay and pensionary benefits approved by the Cabinet on 3rd May, 2017

The Union Cabinet chaired by the Prime Minister Shri Narendra Modi approved important proposals relating to modifications in the 7th CPC (Central Pay Commission) recommendations on pay and pensionary benefits in the course of their implementation. Earlier, on 29th June, 2016, the Cabinet had approved implementation of the recommendations with an additional financial outgo of ₹84,933 crore for 2016-17 (including arrears for 2 months of 2015-16).

The benefit of the proposed modifications will be available with effect from 1st January, 2016, i.e., the date of implementation of 7th CPC recommendations. With the increase approved by the Cabinet, the annual pension bill alone of the Central Government is likely to be ₹1,76,071 crore. Some of the important decisions of the Cabinet are mentioned below:

1. Revision of pension of pre – 2016 pensioners and family pensioners.

The Cabinet approved modifications in the recommendations of the 7th CPC relating to the method of revision of pension of pre-2016 pensioners and family pensioners based on suggestions made by the Committee chaired by Secretary (Pensions) constituted with the approval of the Cabinet. The modified formulation of pension revision approved by the Cabinet will entail an additional benefit to the pensioners and an additional expenditure of approximately ₹5031 crore for 2016-17 over and above the expenditure already incurred in revision of pension as per the second formulation based on fitment factor. It will benefit over 55 lakh pre-2016 civil and defence pensioners and family pensioners.

While approving the implementation of the 7th CPC recommendations on 29th June, 2016, the Cabinet had approved the changed method of pension revision recommended by the 7th CPC for pre-2016 pensioners, comprising of two alternative formulations, subject to the feasibility of the first formulation which was to be examined by the Committee.

In terms of the Cabinet decision, pensions of pre-2016 pensioners were revised as per the second formulation multiplying existing pension by a fitment factor of 2.57, though the pensioners were to be given the option of choosing the more beneficial of the two formulations as per the 7th CPC recommendations.

In order to provide the more beneficial option to the pensioners, Cabinet has accepted the recommendations of the Committee, which has suggested revision of pension based on information contained in the Pension Payment Order (PPO) issued to every pensioner. The revised procedure of fixation of notional pay is more scientific, rational and implementable in all the cases. The Committee reached its findings based on an analysis of hundreds of live pension cases. The modified formulation will be beneficial to more pensioners than the first formulation recommended by the 7th CPC, which was not found to be feasible to implement on account of non-availability of records in a large number of cases and was also found to be prone to several anomalies.

2. Disability Pension for Defence Pensioners

The Cabinet also approved the retention of percentage-based regime of disability pension implemented post 6th CPC, which the 7th CPC had recommended to be replaced by a slab-based system.

The issue of disability pension was referred to the National Anomaly Committee by the Ministry of Defence on account of the representation received from the Defence Forces to retain the slab-based system, as it would have resulted in reduction in the amount of disability pension for existing pensioners and a reduction in the amount of disability pension for future retirees when compared to percentage- based disability pension.

The decision which will benefit existing and future Defence pensioners would entail an additional expenditure of approximately ₹130 crore per annum.

3. Changes in Pay Structure and Revision of the three Pay Matrices:

The Cabinet, while approving the 7th CPC recommendations for their implementation on 29th June, had made two modifications in the Defence Pay Matrix as under:

(i) Index of Rationalisation (IOR) of Level 13A (Brigadier) may be increased from 2.57 to 2.67.

(ii) Additional 3 stages in Levels 12A (Lt. Col.), 3 stages in Level 13 (Colonel) and 2 stages in Level 13A (Brigadier) may be added.

The Cabinet has now approved further modifications in the pay structure and the three Pay Matrices, i.e. Civil, Defence and Military Nursing Service (MNS). The modifications are listed below:

(i) Defence Pay Matrix has been extended to 40 stages similar to the Civil Pay Matrix: The 7th CPC had recommended a compact Pay Matrix for Defence Forces personnel keeping in view the number of levels, age and retirement profiles of the service personnel. Ministry of Defence raised the issue that the compact nature of the Defence Pay Matrix may lead to stagnation for JCOs in Defence Forces and proposed that the Defence Pay Matrix be extended to 40 stages. The Cabinet

decision to extend the Defence Pay Matrix will benefit the JCOs who can continue in service without facing any stagnation till their retirement age of 57 years.

(ii) IOR for Levels 12 A (Lt. Col. and equivalent) and 13 (Colonel and equivalent) in the Defence Pay Matrix and Level 13 (Director and equivalent) in the Civil Pay Matrix has been increased from 2.57 to 2.67: Variable IOR ranging from 2.57 to 2.81 has been applied by the 7th CPC to arrive at Minimum Pay in each Level on the premise that with enhancement of Levels from Pay Band 1 to 2, 2 to 3 and onwards, the role, responsibility and accountability increases at each step in the hierarchy. This principle has not been applied in respect of Levels 12A (Lt. Col. and

equivalent), 13 (Colonel and equivalent) and 13A (Brigadier and equivalent) of Defence Pay Matrix and Level 13 (Director and equivalent) of the Civil Pay Matrix on the ground that there was a disproportionate increase in entry pay at the level pertaining to GP 8700 in the 6th CPC regime. The IOR for Level 13A (Brigadier and equivalent) in the Defence Pay Matrix has already been revised upwards with the approval of the Cabinet earlier. In view of the request from Ministry of Defence for raising the IOR for Levels 12 A and 13 of the Defence Pay Matrix and requests from others, the IOR for these levels has been revised upwards to ensure uniformity of approach in determining the IOR.

(iii) To give effect to the decisions to extend the Defence Pay Matrix and to enhance the IORs, the three Pay Matrices – Civil, Defence and MNS – have also been revised. While doing so, two calculation errors noticed in the MNS Pay Matrix have also been rectified.

(iv) To ensure against reduction in pay, benefit of pay protection in the form of Personal Pay was earlier extended to officers when posted on deputation under Central Staffing Scheme (CSS) with the approval of Cabinet. The benefit will also be available to officers coming on Central Deputation on posts not covered under the CSS.

PAY MATRIX CIVIL EMPLOYEES

************GO HOME PAGE *****

Clarifications and update on the Cabinet decisions on pay and pensionary issues emanating out of the 7th Central Pay Commission: By Maj Navdeep Singh (Reproduced from his blog site)

There is a press note floating around on social media regarding certain decisions taken by the Cabinet related to pay and pensionary modalities related to the 7th Central Pay Commission (CPC). Though many have questioned its veracity, this is to confirm that it is absolutely a valid document and has been officially issued by the Ministry of Finance.

That said, let me run through some of the important decisions taken by the Cabinet, clarifications thereon and their impact. Please note that the new Pay Rules issued by the Ministry of Defence do not take into account the changes in the pay structure or removal of anomalies and these shall be incorporated through separate amendments in the rules issued on 03 May 2017.

Restoration of Percentage based Disability Pension Rates

The 7th CPC had recommended ‘flat/slab’ rates of disability pension for the defence services rather than the ones based upon ‘percentage of pay’. Civil disabled personnel were however retained on the percentage system as before. As stated earlier, frankly, I never expected this regressive 7th CPC recommendation to be accepted by the Government, but unfortunately it was. While recommending this aspect, the 7th CPC had also made unfounded and uncharitable remarks against disabled soldiers by casting aspersions on those who have incurred disabilities while in service which was discussed in detail by me earlier in my opeds, here and here. This resulted in a massive decrease after the 7th CPC resulting in a payout even lower than 6th CPC rates for almost all post-2016 retirees of all ranks and also for pre-2016 retirees of certain ranks. The arbitrariness of this decision becomes evident from the following chart at the apex levels:

Thankfully, the then Defence Minister, Mr Manohar Parrikar, fully understood the issue and took personal interest in getting the issue referred to an Anomaly Committee. The Defence Services HQ as well as the Ministry, and even civilian employee organisations, supported the resolution of this anomaly which now stands addressed and the Cabinet has decided to retain the old system of calculation on percentage basis, that is, 30% of pay shall remain the disability element for 100% disability. I however do hope that a protection clause is introduced for pre-2016 retirees of lower ranks who stood to gain from the slab rates.

Improvement in Pension calculation system for pre-2016 civil and defence retirees

The Cabinet has also accepted an improvement over and above the system of pension calculation which was finally effectuated after the 7th CPC. Rather than basing the pensionary calculations on the “Old Pension X 2.57” formula, an option would be provided to calculate the pension based upon the notional pay stage from which the employee had retired as opposed to the minimum of pay as was the system followed till the 6th CPC. Calculation of pension in this manner would definitely enhance the pension of civil pensioners and perhaps a small number of defence pensioners, who, in all probability would be provided the opportunity of choosing the most beneficial option, that is, the new formula, 2.57 multiplication formula or OROP rates. Contrary to popular perception, this does not exactly result in OROP for pre-2016 civil employees as is being projected, since while this is based on notional data, the military OROP is operated on live date of fresh retirees, moreover while this system is expected to be revised only after ten years, the military OROP as per the current scheme is meant to be revised after every five years.

Issuance of Pay Rules rather than Instructions on Pay

There were messages that the Chiefs of the Defence Services have been sidelined and downgraded since the earlier system of issuance of Special Army Instructions, Special Navy Instructions and Special Air Force Instructions (SAI/SNI/SAFI) has been discontinued and a new dispensation of ‘Pay Rules’ has been initiated. This seems to be the negative imagination of fertile minds. SAI/SNI/SAFI were never issued under the authority of the Chiefs of the Defence Services HQ but were always issued by the Ministry of Defence, that is, the Government of India. ‘Orders’ such as Army Orders (AO) etc were (and are) issued by the Defence Services HQ under the power of the Chiefs. The new Pay Rules have been promulgated under the authority of Article 309 of the Constitution of India and are statutory in character rather than being mere executive instructions like was the case till now. With this, the pay rules of the Defence Services are at par with the statutory pay rules of the civil services which are also issued under the authority of Article 309 of the Constitution of India.

Defence Pay Matrix to have 40 stages

The 7th CPC had recommended only 24 stages in the defence matrix while 40 stages were provided to civilians. This anomaly has been rectified and now the defence pay matrix shall also have 40 stages. This will particularly be helpful for JCOs towards the retiring years and will also beneficially affect their pension and other retiral benefits.

Multiplication factor of 2.67

This anomaly had been rectified earlier for Brigadiers and a multiplication factor of 2.67 had been applied for the said rank. Now the same benefit has also been extended to Lieutenant Colonels, Directors to Government of India and Colonels, that is, Levels 12A and 13 of the Pay Matrix.

Other Anomalies

There shall be pay protection for the amount of Military Service Pay (MSP) on promotion from the rank of Brigadier to Major General. It may be recalled that MSP is not entitled to ranks above the rank of Brigadier. No decision has been taken by the Government on the aspect of Non Functional Upgradation till now since the matter is being considered sub judice. On directions of the Supreme Court, the Government is re-considering the issue of NFU for Central Armed Police Forces for which a meeting was recently held. The issue is to be considered by the Government and the fresh decision is to be placed before the Supreme Court in August 2017. The most pertinent anomaly of enhancement of Military Service Pay, especially for JCOs, also remains pending along with other matters and probably these issues would be clearer after various anomaly committees submit their reports and a decision is taken thereafter by the Cabinet. The committee on allowances has already submitted its report which will now be examined by the Government. Unlike pay and pension which are admissible retrospectively from 01 January 2016, most freshly rationalized allowances shall only be admissible prospectively.

This is all I have to say at present, please DO NOT mail me individual queries on email or social media. You are free to discuss the above @ the comments section of this post.

Maj Navdeep Singh

*********************GO HOME PAGE *****

We have placed all other details on 7th CPC incl the implementation Instructions in this blog site covering all aspects for all Civil and Def CG Employees and Pensioners under following posts (CLICK ON TITLES) :-

a) 7th CPC IMPLEMENTATION 2016 - ALL IN ONE DETAILS

b) 7th CPC DEFENCE PENSIONS - GAIN OR NO-GAIN

c) EXERCISING OPTIONS FOR FIXATION IN JAN OR JUL 2016 (SERVING)

OLD POSTS

| d) 7th CPC IMPLEMENTATION |

| e) 7 CPC - MoD RESOLUTION ISSUED |

| f) 7th CPC - LATEST NEWS |

| g) 7th PAY COMMISSION -2016 |

| h) ANAMOLIES METED OUT BY PAST CPCs TO FAUJ |

Email ID Wg Cdr RK Bali

ReplyDeleteav_int@yahoo.co.in

The pay matrix published above does not include cabinet decisions of 03 May 2017. Examples given are based on this pay matrix. In example for Lt Cold the period 30 yrs and rank Brig appear to be erroneous. Please review/clarify.

ReplyDeleteWg Cdr RK Bali

12989

IAF

av_int@yahoo.co.in

Dr. Major. KL Chandrasekhar

ReplyDeleteE-Mail: major4511@gmail.com

Mob: 9677807632

What is the fate of pre-1996 retired Majors / Lt.Cdrs / Sqn. Ldrs, who have put in more than 13 years of Commissioned Service, but less than 20 years and with full Qualifying service for Pension?

This category of Officers in all the three Services are no more than 800 and this number is fast diminishing due to all of them being over 70 years old.

Can any, 'pro-bono' sympathizer take up these hapless lots' financial interest at such an advanced age please? Mails sent to Gen Satbir / Major Navdeep and petitions to Def Minister / PM have all fallen deaf ears.

Major K P Raveendran (Retd)

ReplyDeletemajorraveendran@gmail.com

Sir,

I had put in 25 years pensionable srvice, including pre commissioned service.

Became a Major after 11 years of service.

Very few officers of this category is alive today.

Why we are also considered for Lt Col Pension.

We had Part B and Part D exams, which is not there for present day Lt Cols.

Is Govt of India thinking of this type of Veterans, who are very few.

Regards,

Major K P Raveendran,

Mobile # 9886777465