7 CPC IMPLEMENTATION - ARMD FORCES PENSIONS

The M0D has finally issued the 7th CPC Implementation letter for Pre 2016 retirees. This letter can be downloaded from their link :- http://www.desw.gov.in/circulars/implementation-7th-cpc-respect-pre-2016-retirees-revision-pension-dated-05092017.

The letter gives out both the formulations in fixing pensions for 7 CPC, as were contained in their letters of May 17 which are already available duly explained and analised on our web post at :-

7th CPC IMPLEMENTATION 2016 - ALL IN ONE DETAILS -------;

http://signals-parivaar.blogspot.in/2017/03/7th-cpc-implementation.html

The first formulation as mentioned is by taking your last pay as in your PPO and notionally fixing the same as on 01 Jan 2016 (Pre-revised) and then looking up the corresponding or bit higher stage in the Def Matrix, which is also available here in this post. The second method/formulation which is implementation multiplication factor of 2.7 has already been applied to us (Pre-2014 Retirees) on our OROP pension as on 31 Dec 2015, means the pension which is being paid to us as on date with Dearness relief.

PRE-2014 PENSIONERS - As regards the first formulation, it is suffice to mention for our understanding that the notional fixation in case of every Pre-2014 FAUJI Pensioner will work out to be less than the second FORMULATION (OROP x 2.57) . This can be seen in their example for a LT COL as given in MoD letter of 05 Sep 17. The same is true for all ranks who are in receipt of the OROP.

Vide para 6 of the said MoD letter the Pensioners will get the higher of the two formulated pensions hence we will continue to get what we are getting today.

It thus simply concludes that the Pre-2014 Pensioners and Family Pensioners are JAISE THHE, as such they should relax and come to VISHRAM.

POST 2013 - PENSIONERS - HOWEVER there is some good news for Pensioners who retired from 01 Jan 2014 to 31 dec 2015, the will get marginal gains that too because of the Def Matrix. This is clear from the example of a Brig given in the said letter. The basic pensions shown in the example on retirement as per his PPO is 39025 = (63150+8900+6000) divided by 2. His Notional Pay therefore on 01 Jan 2016 Pre-revised will be same ie (63150+8900=72050) plus MSP of 6000/-.

Under formulation two the same was revised last year at 39025 X 2.57 = 100295.

However under formulation-one, based on the Notional Pay of 72050, it works out for fixation in 7 CPC scales, as 72050 X 2.57 = 185168. Now look up 185168 in Def Matrix (scroll down and see the matrix) we find that under Level 13 A (GP 8900) stage 10 is lower while stage 11 is higher than this. Therefore his fixation will be Stage 11 ie 187700/- plus MSP of 15500 totaling to 203200.

Hence the revised pension will be 101600 which is higher than his Formulation-two Pension of 100295 as shown above. He will be gainer by Rs 1305/- .

HENCE MY FRIENDS PLEASE NOTE THAT THERE IS NO ENHANCEMENT OF PENSION FOR PRE-2014 PENSIONERS WHILE POST 2013 PENSIONES WILL HAVE MINOR GAINS ONCE THE SAID MOD LETTER IS IMPLEMENTED BY PCDA PENSIONS.

The letter how ever sorts out certain anomalies in Disability Element of Pension and the NPA for doctors which were on hold till now, these will be determined now on the revised Pensions under 7th CPC.

The limits laid down for Family pensioners earlier (Rs 75000 as Max family pension) have accordingly been adjusted and the Family Pensioners getting Liberalised Family Pensions (Offrs) who were most affected by the limits have been exempted from these limits.

The min family pension will be Rs 9000/- and max Rs 75000/- (Except LFP).

There is no change to the basic policies on pension.

Following MoD letters are also of concern for those who wish to dwell deeper into this :-

Mod letters of 4th Sep 17 -

1, http://www.desw.gov.in/sites/default/files/2017.09.04%2017(01)2017(01)-D(Pen-Pol)%20Implementation%20of%207th%20CPC%20in%20respect%20of%20Pre%202016%20retirees..pdf

2. http://desw.gov.in/sites/default/files/2017.09.04%2017(02)2016-D(Pen-Pol).pdf

3. Our Web Post - http://signals-parivaar.blogspot.in/2017/03/7th-cpc-implementation.html

************

(EARLIER POST)

WHAT IS THIS 2.57 OR 2.67 FACTOR AND WHAT WE CAN EXPECT OUT OF IMPLEMENTATION FOR OUR DEFENCE PENSIONS

1. We attended presentation made by Directorate of Army welfarre, AG's Branch on 19th at the local Institute. The subject was Pensions as such the hall was more than full much beyond its capacity.

2. The presentation was in two parts part one which was on various welfae schemes carved out to help the families of those who died in harness or in operations against enemy out of the Corpus generated from the Donations By the Public. Some of the schemes we heard for the first time may be these did not get dissiminated to the veterans using modern methods of social media.

3. The second part was on pensions where the speaker could not make a good mark with the audience mostly because his theme of presentation was covering only basics of pension which is well known to the veterans. There was no way we could pass on our suggestions and difficulty.

4. What all the veterans must know about their pension have been adequately covered on social media and has also been well recorded in this very blog site which is open to all without having to use any log in name or password. Our post of END OF LIFE ISSUES" covers various issues in nut shell.

5. Most veterans were keen to know about the effect of 7th CPC on their pension which could not be covered by the speaker. Among our discussions we noticed that there is utter confusion among us the Veterans on the Multiplication Factor of 2.57 or 2.67 etc etc.

7. We will attempt to clear this fog based on our studies of the 7 CPC report and its Implementation as approved by the Govt during first week of May 2017.

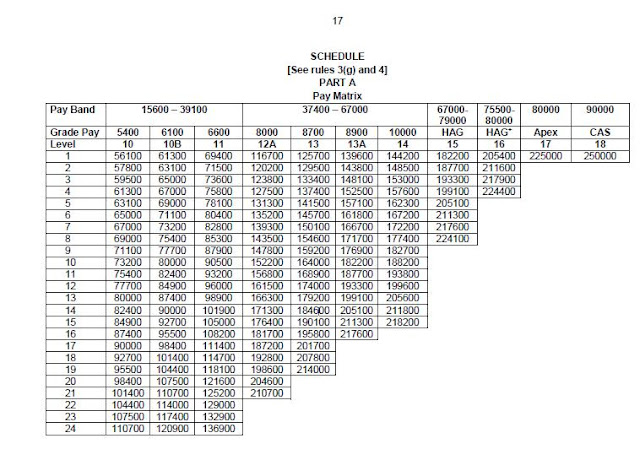

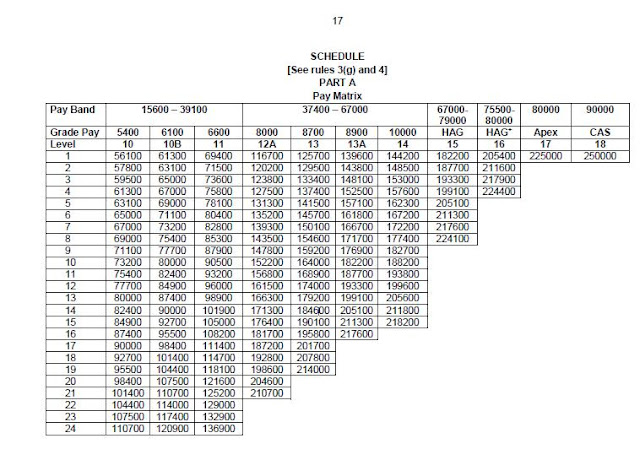

8. The 7 CPC has simply conveted the earstwhile Pay Bands (PBs) into the format of a MATRIX. The Matrix is laid out in levels which pertain to the Grade pay of the 6th CPC and move down the columns into stages. The first stage is the basic minimum of that level and the next stage is derived by giving the yearly increment of 3% rounded off to next 100 & so on. Matrix so approved for Army officers which is incl in the 7 CPC Pay Rules for Army Officers is given below for reference and understanding:-

9. The 7th CPC first decided a multiplication factor for each grade varying between 2.57 and 2.8 depending upon the Grade pay to convert the 6 CPC emoluments into 7 CPC emoluments. They used this MF to multiply the Basic Minimum Pay of that Grade plus the Grade pay with it and rounding the same to nearest rupee. The MSP is separated and is not used in conversion. It is added additionally at uniform level of 15500 for officers upto the rank of Brigadier. Please have a look as to how the First Stage for various ranks has been worked out :-

(a) Lt Col - Min Pay+GP=36400+8000=45400, 45400*2.57=116678

Rounded to 116700 as first stage in level 12A of Matrix.

(b) Col - Min+GP= 40200+8700= 48900, 48900*2.57= 125673

Rounder off to 125700 as first stage in level 13 of Matrix.

(c) Brig - Min+GP= 43390+8900=52290, 52290*2.67=139614

Rounded off to 139700 as first stage in level 13A of Matrix.

(d) Maj Gen - Min+GP =43000+10000 =53000, 53000*2.72=144160

Rounded off to 144200 as fist stage in level 14 of Matrix.

Note - The (Min Pay+GP)* MFs used for Lt (Level 10) , Capt (level 10B) and Majs (Level 11) are 21000*2.67, 22900*2.67, 25980*2.67 respectively.

It will be noticed that the MFs are not uniform and were dderived by the 7 CPC based on some logic like the degree of difficult duty tasks assigned to various levels.

10. Now let us get on to the Fixation formulae from existing / notional pay (as may be worked out for 7CPC based on last pay drawn as given in the PPO at the time of retirement). Here the Govt has used a single Multiplication Factor of 2.57 for both serving and the retired personnel, thats it, hope the issues are clear and your doubts are at rest.

11. Following mail was sent to the environment giving out as to what can happen to Def Pensions and what is that we as pensioners can expect, depending upon which method, out of the two options given below is finally adopted and approved and given out in PCDA(P) Circular likely to be issued shortly.

MY MAIL ON WHAT WE ARE LIKELY TO GAIN OR BE SATISFIED WITH WHAT WE ALREADY HAVE RECEIVED.

"QUOTE"

We all should pray that all pre-2014 retirees incl the pre-2006

retirees who were given OROP, are considered as 6 CPC retirees,

retired with OROP scale of pension (which be taken as our 50% of

our Notional Last Pay drawn) by the Babudom. Its only this way

that we will get some benefit on 7 CPC fixation, as calculated

by you.

OPTION/METHOD – ONE ::

In case they go by the book, which they normally do, and we

the pre 2006 are taken as 5th CPC retirees, they will base our

fixation and calculations of the Notional pay as per our PPO

figs of Last / Avg pay drawn within the given scales. This is

the official method for fixation for Civ offrs as per orders

(which have already been issued on 12 May 2017) for the fixation

of their pensions, then we will not go beyond second or third

stage in our levels of Defence Matrix available on my blog

site also.

Thank God our pensions cannot be reduced below

what we are already getting ie 2.57 times of our OROP, we

will continue in this case with our OROP*2.57 pension figures

only till 2018 when hopefully next review of OROP will take

place. This is what is likely to happen when we get PCDA

circular on fixation of pensions under 7 CPC in terms of the

Cabinet approval dated 03 May 2017.

Let us not lose hope ..

OPTION/METHOD – TWO ::

Let us pray & hope that they start from the OROP base for

us all. In this case there is a minor correction to your

method based on the official method as for civ pensioners

as under:-

LT COL

OROP – 34765 –> deduct MSP ie 3000 = 31765

–>>twice of this will equal as our notional

last pay drawn in 2013 = 63530 (Basic Less MSP) –>> multiply

it by 2.57 (As per 7 CPC Army Pay rules Offrs) = 63530*2.57

which equals to 163272. look up this figure in Def matrix

it falls between stages 161500 & 166300 (L12A) hence taking the

higher one ie 166300 plus 15500 (New MSP) = 181800 as the

Notional pay for a brig with 30 yrs and above. 50% of this

is the pension as on 1-1-2016 ie Rs 90900/-

Pension otherwise 34765*2.57 = 89346

Hence gain 90900-89346 = 1553 per month.

COLONEL-

OROP – 36130 –> deduct MSP ie 3000 = 33130

–>>twice of this will equal as our notional

last pay drawn in 2013 = 66260 (Basic Less MSP) –>> multiply

it by 2.57 (As per 7 CPC Army Pay rules Offrs) = 66260*2.57

which equals to 170290. look up this figure in Def matrix

it falls between stages 168900 & 174000 (L13)- hence taking the

higher one ie 174000 plus 15500 (New MSP) = 189500 as the

Notional pay for a COL with 30 yrs and above. 50% of this

is the pension as on 1-1-2016 ie Rs 94750/-

Pension otherwise 36130*2.57 = 92854

Hence gain 94750-92854 = 1896 per month.

BRIGADIER -

OROP – 37570 –> deduct MSP ie 3000 = 34570

–>>twice of this will equal as our notional

last pay drawn in 2013 = 69140 (Basic Less MSP) –>> multiply

it by 2.57 (As per 7 CPC Army Pay rules Offrs) = 69140*2.57

which equals to 177690. look up this figure in Def matrix

it falls between stages 176900 & 182200 (L13A) hence taking the

higher one ie 182200 plus 15500 (New MSP) = 197700 as the

Notional pay for a brig with 30 yrs and above. 50% of this

is the pension as on 1-1-2016 ie Rs 98850/-

Pension otherwise 37570*2.57 = 96555

Hence gain 98850-96555 = 2295 per month.

MAJOR GENERAL

OROP – 38763 –> deduct MSP ie 3000 = 35763

–>>twice of this will equal as our notional

last pay drawn in 2013 = 71526(Basic Less MSP) –>> multiply

it by 2.57 (As per 7 CPC Army Pay rules Offrs) = 71526*2.57

which equals to 183822. look up this figure in Def matrix

it falls between stages 182700 & 188200 (L14) hence taking the

higher one ie 188200 plus 15500 (New MSP) = 203700 as the

Notional pay for a brig with 30 yrs and above. 50% of this

is the pension as on 1-1-2016 ie Rs 101850/-

Pension otherwise 38763*2.57 = 99620

Hence gain 101850-99620 = 2230 per month.

Knowing the game they play usually with us We do have apprehensions

that THEY will go by Method – One for approval. However its better to think

positively and be happy till PCDA circular comes on Fixation of

Def Pensions and hope there will be better sense to approve Method-Two

to avoid litigations.

ब्रिगेडियर_नरेन्द्र_ढंड

Brigadier Narinder Dhand.

NOIDA -(NCR) - 201303

CLICK - http://signals-parivaar.blogspot.in

7th CPC - ALL IN ONE

OLDER POSTS

The M0D has finally issued the 7th CPC Implementation letter for Pre 2016 retirees. This letter can be downloaded from their link :- http://www.desw.gov.in/circulars/implementation-7th-cpc-respect-pre-2016-retirees-revision-pension-dated-05092017.

The letter gives out both the formulations in fixing pensions for 7 CPC, as were contained in their letters of May 17 which are already available duly explained and analised on our web post at :-

7th CPC IMPLEMENTATION 2016 - ALL IN ONE DETAILS -------;

http://signals-parivaar.blogspot.in/2017/03/7th-cpc-implementation.html

The first formulation as mentioned is by taking your last pay as in your PPO and notionally fixing the same as on 01 Jan 2016 (Pre-revised) and then looking up the corresponding or bit higher stage in the Def Matrix, which is also available here in this post. The second method/formulation which is implementation multiplication factor of 2.7 has already been applied to us (Pre-2014 Retirees) on our OROP pension as on 31 Dec 2015, means the pension which is being paid to us as on date with Dearness relief.

PRE-2014 PENSIONERS - As regards the first formulation, it is suffice to mention for our understanding that the notional fixation in case of every Pre-2014 FAUJI Pensioner will work out to be less than the second FORMULATION (OROP x 2.57) . This can be seen in their example for a LT COL as given in MoD letter of 05 Sep 17. The same is true for all ranks who are in receipt of the OROP.

Vide para 6 of the said MoD letter the Pensioners will get the higher of the two formulated pensions hence we will continue to get what we are getting today.

It thus simply concludes that the Pre-2014 Pensioners and Family Pensioners are JAISE THHE, as such they should relax and come to VISHRAM.

POST 2013 - PENSIONERS - HOWEVER there is some good news for Pensioners who retired from 01 Jan 2014 to 31 dec 2015, the will get marginal gains that too because of the Def Matrix. This is clear from the example of a Brig given in the said letter. The basic pensions shown in the example on retirement as per his PPO is 39025 = (63150+8900+6000) divided by 2. His Notional Pay therefore on 01 Jan 2016 Pre-revised will be same ie (63150+8900=72050) plus MSP of 6000/-.

Under formulation two the same was revised last year at 39025 X 2.57 = 100295.

However under formulation-one, based on the Notional Pay of 72050, it works out for fixation in 7 CPC scales, as 72050 X 2.57 = 185168. Now look up 185168 in Def Matrix (scroll down and see the matrix) we find that under Level 13 A (GP 8900) stage 10 is lower while stage 11 is higher than this. Therefore his fixation will be Stage 11 ie 187700/- plus MSP of 15500 totaling to 203200.

Hence the revised pension will be 101600 which is higher than his Formulation-two Pension of 100295 as shown above. He will be gainer by Rs 1305/- .

HENCE MY FRIENDS PLEASE NOTE THAT THERE IS NO ENHANCEMENT OF PENSION FOR PRE-2014 PENSIONERS WHILE POST 2013 PENSIONES WILL HAVE MINOR GAINS ONCE THE SAID MOD LETTER IS IMPLEMENTED BY PCDA PENSIONS.

The letter how ever sorts out certain anomalies in Disability Element of Pension and the NPA for doctors which were on hold till now, these will be determined now on the revised Pensions under 7th CPC.

The limits laid down for Family pensioners earlier (Rs 75000 as Max family pension) have accordingly been adjusted and the Family Pensioners getting Liberalised Family Pensions (Offrs) who were most affected by the limits have been exempted from these limits.

The min family pension will be Rs 9000/- and max Rs 75000/- (Except LFP).

There is no change to the basic policies on pension.

Following MoD letters are also of concern for those who wish to dwell deeper into this :-

Mod letters of 4th Sep 17 -

1, http://www.desw.gov.in/sites/default/files/2017.09.04%2017(01)2017(01)-D(Pen-Pol)%20Implementation%20of%207th%20CPC%20in%20respect%20of%20Pre%202016%20retirees..pdf

2. http://desw.gov.in/sites/default/files/2017.09.04%2017(02)2016-D(Pen-Pol).pdf

3. Our Web Post - http://signals-parivaar.blogspot.in/2017/03/7th-cpc-implementation.html

************

(EARLIER POST)

WHAT IS THIS 2.57 OR 2.67 FACTOR AND WHAT WE CAN EXPECT OUT OF IMPLEMENTATION FOR OUR DEFENCE PENSIONS

1. We attended presentation made by Directorate of Army welfarre, AG's Branch on 19th at the local Institute. The subject was Pensions as such the hall was more than full much beyond its capacity.

2. The presentation was in two parts part one which was on various welfae schemes carved out to help the families of those who died in harness or in operations against enemy out of the Corpus generated from the Donations By the Public. Some of the schemes we heard for the first time may be these did not get dissiminated to the veterans using modern methods of social media.

3. The second part was on pensions where the speaker could not make a good mark with the audience mostly because his theme of presentation was covering only basics of pension which is well known to the veterans. There was no way we could pass on our suggestions and difficulty.

4. What all the veterans must know about their pension have been adequately covered on social media and has also been well recorded in this very blog site which is open to all without having to use any log in name or password. Our post of END OF LIFE ISSUES" covers various issues in nut shell.

5. Most veterans were keen to know about the effect of 7th CPC on their pension which could not be covered by the speaker. Among our discussions we noticed that there is utter confusion among us the Veterans on the Multiplication Factor of 2.57 or 2.67 etc etc.

7. We will attempt to clear this fog based on our studies of the 7 CPC report and its Implementation as approved by the Govt during first week of May 2017.

8. The 7 CPC has simply conveted the earstwhile Pay Bands (PBs) into the format of a MATRIX. The Matrix is laid out in levels which pertain to the Grade pay of the 6th CPC and move down the columns into stages. The first stage is the basic minimum of that level and the next stage is derived by giving the yearly increment of 3% rounded off to next 100 & so on. Matrix so approved for Army officers which is incl in the 7 CPC Pay Rules for Army Officers is given below for reference and understanding:-

9. The 7th CPC first decided a multiplication factor for each grade varying between 2.57 and 2.8 depending upon the Grade pay to convert the 6 CPC emoluments into 7 CPC emoluments. They used this MF to multiply the Basic Minimum Pay of that Grade plus the Grade pay with it and rounding the same to nearest rupee. The MSP is separated and is not used in conversion. It is added additionally at uniform level of 15500 for officers upto the rank of Brigadier. Please have a look as to how the First Stage for various ranks has been worked out :-

(a) Lt Col - Min Pay+GP=36400+8000=45400, 45400*2.57=116678

Rounded to 116700 as first stage in level 12A of Matrix.

(b) Col - Min+GP= 40200+8700= 48900, 48900*2.57= 125673

Rounder off to 125700 as first stage in level 13 of Matrix.

(c) Brig - Min+GP= 43390+8900=52290, 52290*2.67=139614

Rounded off to 139700 as first stage in level 13A of Matrix.

(d) Maj Gen - Min+GP =43000+10000 =53000, 53000*2.72=144160

Rounded off to 144200 as fist stage in level 14 of Matrix.

Note - The (Min Pay+GP)* MFs used for Lt (Level 10) , Capt (level 10B) and Majs (Level 11) are 21000*2.67, 22900*2.67, 25980*2.67 respectively.

It will be noticed that the MFs are not uniform and were dderived by the 7 CPC based on some logic like the degree of difficult duty tasks assigned to various levels.

10. Now let us get on to the Fixation formulae from existing / notional pay (as may be worked out for 7CPC based on last pay drawn as given in the PPO at the time of retirement). Here the Govt has used a single Multiplication Factor of 2.57 for both serving and the retired personnel, thats it, hope the issues are clear and your doubts are at rest.

11. Following mail was sent to the environment giving out as to what can happen to Def Pensions and what is that we as pensioners can expect, depending upon which method, out of the two options given below is finally adopted and approved and given out in PCDA(P) Circular likely to be issued shortly.

MY MAIL ON WHAT WE ARE LIKELY TO GAIN OR BE SATISFIED WITH WHAT WE ALREADY HAVE RECEIVED.

"QUOTE"

We all should pray that all pre-2014 retirees incl the pre-2006

retirees who were given OROP, are considered as 6 CPC retirees,

retired with OROP scale of pension (which be taken as our 50% of

our Notional Last Pay drawn) by the Babudom. Its only this way

that we will get some benefit on 7 CPC fixation, as calculated

by you.

OPTION/METHOD – ONE ::

In case they go by the book, which they normally do, and we

the pre 2006 are taken as 5th CPC retirees, they will base our

fixation and calculations of the Notional pay as per our PPO

figs of Last / Avg pay drawn within the given scales. This is

the official method for fixation for Civ offrs as per orders

(which have already been issued on 12 May 2017) for the fixation

of their pensions, then we will not go beyond second or third

stage in our levels of Defence Matrix available on my blog

site also.

Thank God our pensions cannot be reduced below

what we are already getting ie 2.57 times of our OROP, we

will continue in this case with our OROP*2.57 pension figures

only till 2018 when hopefully next review of OROP will take

place. This is what is likely to happen when we get PCDA

circular on fixation of pensions under 7 CPC in terms of the

Cabinet approval dated 03 May 2017.

Let us not lose hope ..

OPTION/METHOD – TWO ::

Let us pray & hope that they start from the OROP base for

us all. In this case there is a minor correction to your

method based on the official method as for civ pensioners

as under:-

LT COL

OROP – 34765 –> deduct MSP ie 3000 = 31765

–>>twice of this will equal as our notional

last pay drawn in 2013 = 63530 (Basic Less MSP) –>> multiply

it by 2.57 (As per 7 CPC Army Pay rules Offrs) = 63530*2.57

which equals to 163272. look up this figure in Def matrix

it falls between stages 161500 & 166300 (L12A) hence taking the

higher one ie 166300 plus 15500 (New MSP) = 181800 as the

Notional pay for a brig with 30 yrs and above. 50% of this

is the pension as on 1-1-2016 ie Rs 90900/-

Pension otherwise 34765*2.57 = 89346

Hence gain 90900-89346 = 1553 per month.

COLONEL-

OROP – 36130 –> deduct MSP ie 3000 = 33130

–>>twice of this will equal as our notional

last pay drawn in 2013 = 66260 (Basic Less MSP) –>> multiply

it by 2.57 (As per 7 CPC Army Pay rules Offrs) = 66260*2.57

which equals to 170290. look up this figure in Def matrix

it falls between stages 168900 & 174000 (L13)- hence taking the

higher one ie 174000 plus 15500 (New MSP) = 189500 as the

Notional pay for a COL with 30 yrs and above. 50% of this

is the pension as on 1-1-2016 ie Rs 94750/-

Pension otherwise 36130*2.57 = 92854

Hence gain 94750-92854 = 1896 per month.

BRIGADIER -

OROP – 37570 –> deduct MSP ie 3000 = 34570

–>>twice of this will equal as our notional

last pay drawn in 2013 = 69140 (Basic Less MSP) –>> multiply

it by 2.57 (As per 7 CPC Army Pay rules Offrs) = 69140*2.57

which equals to 177690. look up this figure in Def matrix

it falls between stages 176900 & 182200 (L13A) hence taking the

higher one ie 182200 plus 15500 (New MSP) = 197700 as the

Notional pay for a brig with 30 yrs and above. 50% of this

is the pension as on 1-1-2016 ie Rs 98850/-

Pension otherwise 37570*2.57 = 96555

Hence gain 98850-96555 = 2295 per month.

MAJOR GENERAL

OROP – 38763 –> deduct MSP ie 3000 = 35763

–>>twice of this will equal as our notional

last pay drawn in 2013 = 71526(Basic Less MSP) –>> multiply

it by 2.57 (As per 7 CPC Army Pay rules Offrs) = 71526*2.57

which equals to 183822. look up this figure in Def matrix

it falls between stages 182700 & 188200 (L14) hence taking the

higher one ie 188200 plus 15500 (New MSP) = 203700 as the

Notional pay for a brig with 30 yrs and above. 50% of this

is the pension as on 1-1-2016 ie Rs 101850/-

Pension otherwise 38763*2.57 = 99620

Hence gain 101850-99620 = 2230 per month.

Knowing the game they play usually with us We do have apprehensions

that THEY will go by Method – One for approval. However its better to think

positively and be happy till PCDA circular comes on Fixation of

Def Pensions and hope there will be better sense to approve Method-Two

to avoid litigations.

ब्रिगेडियर_नरेन्द्र_ढंड

Brigadier Narinder Dhand.

NOIDA -(NCR) - 201303

CLICK - http://signals-parivaar.blogspot.in

7th CPC - ALL IN ONE

we have placed all such details on 7th CPC incl

the implementation

Instructions in this blog site

covering all aspects for all Civil and Armed

forces

CG Employees and Pensioners under following

posts:-

| d) 7th CPC IMPLEMENTATION |

| e) 7 CPC - MoD RESOLUTION ISSUED |

| f) 7th CPC - LATEST NEWS |

| g) 7th PAY COMMISSION -2016 |

| h) ANAMOLIES METED OUT BY PAST CPCs TO FAUJ |

Request post an example with the rank of Majors and equivalents as all the examples is from Lt Cols and above. As per defence pay matrix the majors are at level 11 and the multiplication factor is 2.67 but have been paid @ 2.57.

ReplyDeleteRequest clarification

While granting OROP , the Govt notified in its letter dated 7th Nov 2015 as under:

ReplyDeleteTo begin with, pension of the past pensioners would be re-fixed on the basis of pension of retirees of calendar year 2013 and the benefit will be effective with effect from 1.7.2014.

ii. Pension will be re-fixed for all pensioners on the basis of the average of minimum and maximum pension of personnel retired in 2013 in the same rank and with the same length of service.

In my opinion, the above ruling automatically strikes down the notion of fixing pensions of past pensioners by linking them to last drawn pay. Instead, pension is to be linked only to the pension drawn by retirees of the reference year which is 2013 as per Govt’s own admission. So now if the Govt wants to change goal posts by linking the pension fixation to the last drawn pay as per one’s PPO, it will lead to an absurd situation of several pensions for the same rank

So whatever factor is applied to 6th cpc retirees of 2014, the same factor should be applied to all the pensioners irrespective of last drawn pay.

Col Sharad Paranjape, Retd

sharpara@gmail.com

This is regarding first stage for various ranks which seem to be arbitrary. Minimum of fitment tables for various ranks as per SAI/2S/2008 should have been used in stead.

ReplyDeleteVeteran AVM RP Mishra avmrpm@gmail.com

Dear Col Sharad Paranjape,

ReplyDeleteThank you for your inputs.I fully support your views that all pre 2014 retirees had their pensions brought at some sort of parity with 6th CPC pensions and pay, as such the same should be the base for fixing notional pay for 7 CPC.

That is why I added the last word as avoid litigation in my above post.

Brig NK DHAND

Pre 1996 retirees will be at great disadvantage because first they are going to fix in V pay commission which said clubbing of increments and giving one for three. Also they fixed pay in the minimum of scale.

ReplyDeletePlease clarify. Manjit Singh, manjit.davinder@gmail.com

With reference to Manjit's post, I may add that if Govt genuinely wants to honour its commitment given in the OROP letter of 7 Nov 2015, it cannot discriminate between retirees of different vintages like pre-1996, pre 2006 etc. As per Govt notification, every pensioner on 1-7-2014 became entitled to average of max and min pension drawn by pensioners of his rank in 2013. I mention only "rank" and have deliberately omitted "same service" because all pensioners are deemed to have rendered 33 years service by virtue of the delinking circular issued subsequent to grant of OROP. The OROP orders have virtually abolished all different classes of pre-1-7-2014 pensioners and replaced those by only one class, i.e. "Pensioners as on 1-7-2014" and simultaneously changed the basis of pension from Last Pay Drawn to Pension drawn in 2013. Thus there is no justification for applying a different 7th CPC factor to different pensioners. This class will get a new name (and new pension entitlement) on 1-7-19, i.e. "Pensioners as on 1-7-2019" when 5-year equalization becomes due. Views expressed above pertain only to pensioners as on 1-7-14. More knowledgable veterans are welcome to correct or endorse as deemed fit.

ReplyDeleteCol Sharad Paranjape, Veteran

sharpara@gmail.com

Dear Col Paranjape,

ReplyDeletePl refer to your comment below and the sentence hi-lighted.

Most of us make a mistake here. The DL 33 rule got abolished on orders of supreme court where in it ruled that the pension paid to any pensioner will not be less than half of the minimum pay in the pay band of the rank last held. It’s the min possible pension which was to be paid on re-fixation due on CPCs implementation in the past to any rank. Therefore, reducing the same further by a factor of QS/33 was not legally tenable. Its not that lesser Qualifying service had been waved off by the Honourable SC of India.

Most of us faulter here in our understanding.

The amount of pension being paid in OROP even for a pensioner with QS of 20 Yrs is more than this a/m MINIMUM as such the SC ruling does not apply here. The OROP pension thus gets curtailed depending upon the QS of the retirees.

You are right that OROP has been able to bring some sort of parity among the Pre 2014 retirees as such we hope that our pensions under 7 CPC will be Re-fixed based on the OROP amounts as on 01 Jan 2016 whee in we all will gain couple of thousands as enhancement in our pensions.

Warm regards

ब्रिगेडियर_नरेन्द्र_ढंड

Brigadier Narinder Dhand.

NOIDA -(NCR) - 201303

CLICK - http://signals-parivaar.blogspot.in

Dear Mr Manjit,

ReplyDeleteYou are correct all hopes of parity in pension as recommended by the 7 CPC for all CG Pensioners have been laid to rest by the Govt by adopting the third formulae in fixation of pensions as given in the DPPW OM dated 12 May 2017.

May be some organisations will adopt legal courses, which in my opinion will not be much tenable

Brig Narinder Dhand

Dear AVM RP Misra,

ReplyDeleteYou are right the min for offrs Lt Cols & below has not seem to have been taken in for fixation of Stage 1 in their levels.

Narinder

Sir ,You are doing a great service to the veterans and our families.May. God's Blessings be with you and family members.Saju George,veteran.

ReplyDeleteSir

ReplyDeleteOROP is applicable to retirees prior to July 2014. A large number of officers have retired prior to 01 Jan 16 and after July 14 and I am one of them.

My basic pension is fixed as Rs 38500/- wef July 15 having stagnated for four years on the maximum of Pay Rs 67,000+ Rs 10,000(GP) at the time of supeannuation.

kindly advice/comment about fixation of pension of officers who have retired in different ranks between Aug 14 to Dec 15 not getting the benifits of OROP.

How much increase I can expect in my basic pension wef 01 Jan 16 based on the latest pension order.

Maj Gen R C Padhi

Dear Gen Padi,

ReplyDeleteWe have already updated the oost covering Post 01 Jan 2014 Retirees and hope you will find your qry answered there.

It should be 77000X2.57= 197890 check Matrix. Stage 12 of Level 14 199600.

50% - 99800 plus DA 4% - 103376 However in case any Brig is getting more than this your pension will be up graded to next stage.

Best wishes

Big Narinder Dhand

_________________________________

NOTE :- veterans, please give your Rank Name and E mail ID as part of the Comments so that we can respond. In many cases many members have rightly responded to publishes comments.

Anonymous comments are considered as spams and not published by the system, these get auto - deleted

With respect to MoD letter dated 05 September 2017, pension of all Lt Gen (Commanders), which was 102800 as per their OROP pension X 2.57, will go up to 112500 as per level 17 of VII CPC matrix.

ReplyDeleteDear Sir,

ReplyDeleteWe are grateful for the most useful info and examples you give so that we understand the method of fixing pension. Many of us have benefited and hence thank you so much. Regards,

Wg Cdr VS Hattangady Veteran

vshattan@gmail.com Nashik 422008

Dear Sir,

ReplyDeleteWhile granting OROP pension of the past pensioners would be re-fixed on the basis of pension of retirees of calendar year 2013.

Based on this the next revision at 5 year interval of OROP should be 1.7.2018 and not 2019

Dear Sir,

ReplyDeleteWhile a lot of efforts have been out by you to explain the issues, I request you to kindly help me further. I retired in 2003 as Major with 24 yrs service.Vide circular 14,my pension was revised to Lt col(TS)wef 01012006 at Rs 23082/ by issue of corr PPO and not as 26265/ subsequent to DL 33 yrs rule.Ofcourse it was revised to 32428/ as per OROP table for 24 yrs service.My query is whether 23082 was corrector I am missing out on some points.

Thanks

Maj Tiwari

kamleshtiwari81@yahoo.com